Most 401(k) plans must conduct yearly nondiscrimination tests to demonstrate they do not unjustly benefit workers. Steven Azoury, the owner of Azoury Financial in Troy, Michigan, adds, "If the employer fails (the exams), it's highly punishing." A company may be forced to reimburse workers who are highly rewarded or considered to be indispensable. Or, as Azoury sees it, the whole idea might be deemed illegal moving forward. But there is a method to avoid the inconvenience and cost of nondiscrimination exams. A safe harbor 401(k) allows an employer to provide workers the same tax advantages as a traditional 401(k) plan without subjecting them to the time-consuming and costly yearly testing requirements. What follows is an explanation of the safe harbor 401(k) guidelines, including how they work, whether or not they comply with federal regulations, and how you may take advantage of your employer's matching contributions.

How Does A Safe Harbor 401(K) Plan Work?

When it comes to helping workers prepare for retirement, a safe harbor 401(k) is quite similar to a standard 401(k) in that it offers tax breaks. The employer contribution to the safe harbor 401(k) plan might come in one of three forms:

Contributions Non-Elective:

There is a mandatory employer contribution of at least 3% of an eligible employee's salary into the plan, regardless of whether or not the employee makes any contributions.

Simple Concordance:

Employers must contribute at least as much as their employees who are qualified for the plan (up to 3 percent of pay) and a reduced amount (up to 5 percent of salary).

Improved Pairing

For all contribution amounts, the minimum required from the employer is basic matching.

Employer contributions to a safe harbor 401(k) must be immediately 100% vested, independently of whether the investment is a matching contribution, is restricted to workers who participate, or is offered to employees irrespective of whether they contribute. Each year, businesses must provide the following information to their workers who are qualified for the plan to meet the safe harbor requirements:

- The employee's benefits and responsibilities are under the plan.

- How workers may contribute to their retirement savings.

Provided no later than 30 days and no sooner than 90 days before the start of the plan year, this data is required. Since the safe harbor features must be in place at least 3 months before the plan year starts, the final day to initiate a new safe harbor 401(k) is in October. An existing plan may have a safe harbor provision added to it, and this has to be in place by January 1; however, workers must be informed of the plan's regulations at least thirty days before they take effect.

What Difficulties Does A Safe Harbor 401(K) Solve?

Employers of all sizes may take advantage of a safe harbor 401(k) plan. Still, those with fewer than 100 employees may find it particularly helpful due to the time and money required to pass the yearly nondiscrimination tests required of traditional 401(k) retirement plans. For instance, a standard 401(k) requires a discrimination test to ensure it doesn't favor higher-paid employees over those with lesser salaries. There are two compliance checks that the strategy must keep passing:

The Actual Proportion Of Deferral:

As part of our analysis, we look at how much more or less high-income workers choose to defer into their plan than lower-income workers.

Percentage Of Actual Contribution:

The amount of money contributed to a retirement plan, including any matching contributions from an employer, is measured and compared amongst workers of different income levels.

Conclusion

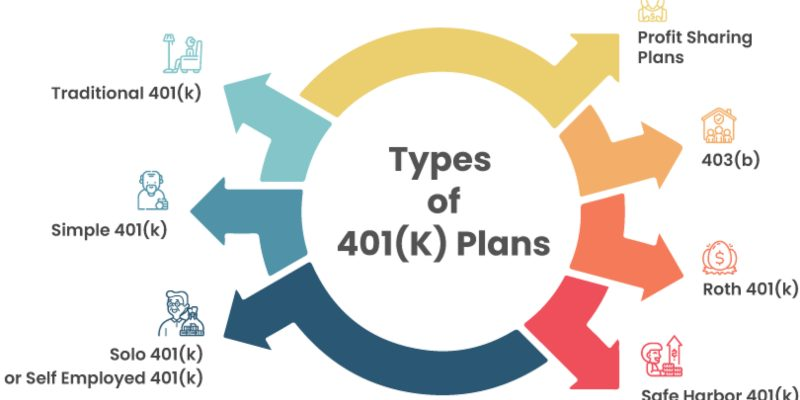

A 401(k) plan is a qualifying plan in which employees may have their employers put away a certain percentage of their pay into a separate account. Profit-sharing, company bonuses, pre-ERISA systematic investment pensions, and rural cooperative plans are all possible underlying plans. Deferred earnings (interventional deferrals) often do not incur federal income tax deductions at the time of postponement and are not shown as income, mostly on the employee's tax return. Convertible elective deferrals are optional contributions to a 401(k) plan normally taxed by the regulations applicable to Roth IRAs. To be clear, employees must report Roth deferrals as income in the year they are made.